The release of the 6th Anti-Money Laundering Directive (6AMLD) is a breakthrough milestone in the ongoing fight against global financial crime. This is more than simply another policy update; it represents a big step forward in tightening the loops around money laundering activities and improving the integrity of financial institutions around the world. 6AMLD is a big step forward by instituting tough procedures and widening the scope of predicate offences to ensure a more comprehensive crackdown on money laundering.

What is 6AMLD?

The 6th Anti-Money Laundering Directive (6AMLD) is a pivotal component of the European Union’s efforts to combat money laundering and terrorism financing. Adopted in October 2018 and enacted in December 2020, it represents a significant advancement over its predecessors, particularly the Fourth (4AMLD) and Fifth (5AMLD) Anti-Money Laundering Directives.

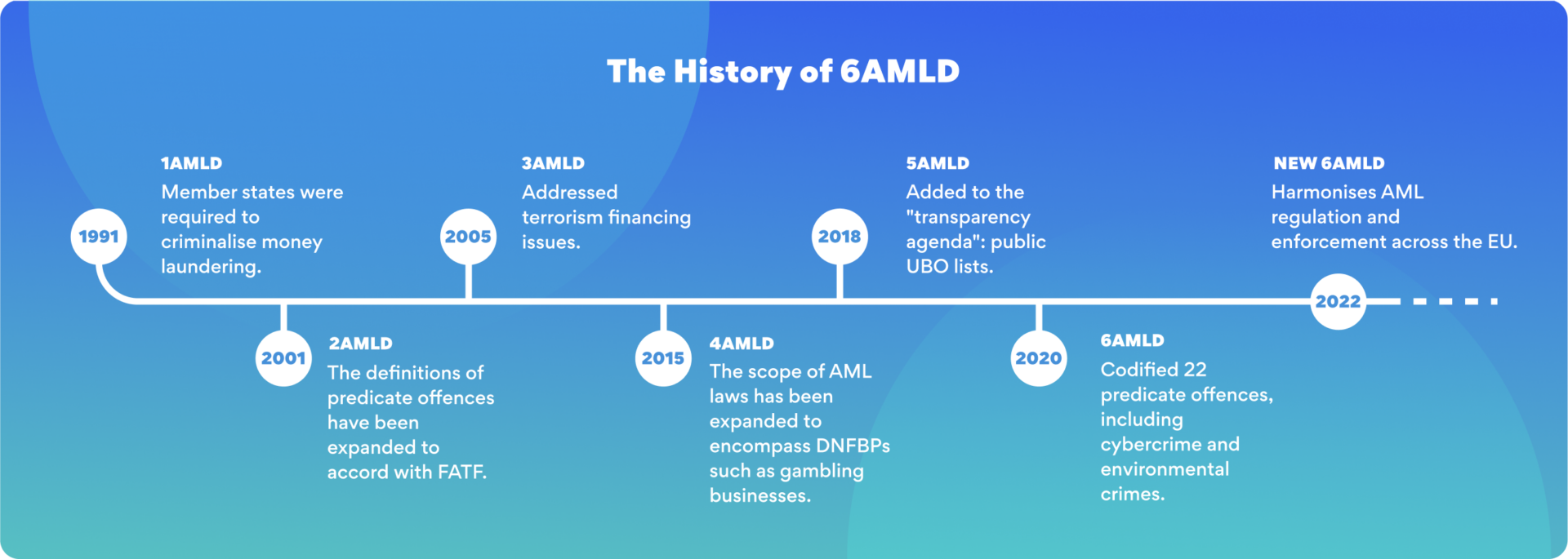

The History of AMLD

What is the Scope of 6AMLD?

6AMLD broadens the scope of Anti-Money Laundering (AML) legislation by introducing harmonised definitions of money laundering offences across EU member states. These definitions encompass a wide range of actions, including aiding, abetting, inciting, and attempted offenses. The directive aims to hold individuals and legal entities accountable for their involvement in such activities, imposing severe penalties, including imprisonment of up to four years and additional sanctions. Notably, it extends criminal liability to legal persons, subjecting them to fines, sanctions, and even judicial winding-up.

What are the 6AMLD 22 Predicate Offences?

A predicate offence, or predicate crime, is a crime that is part of a greater crime. In a financial setting, the predicate offence is any crime that results in monetary proceeds. The greater crime would be money laundering or financing of terrorism.

6AMLD 22 Predicate Offences

Why is 6AMLD Important?

6AMLD assists member nations in combating both money laundering and terrorism financing, which benefits local and regional governments and promotes economic prosperity. It is the first legislation to specifically list cybercrime and environmental crimes as predicate offences.

Increased Regulatory Scope

6AMLD increases the number of offences that qualify as money laundering, including “aiding and abetting.” Prior to 6AMLD, EU money laundering regulations attempted to prosecute only those who profited directly from the act of money laundering; however, the new rules hold so-called “enablers” legally liable.

Practically, “aiding and abetting” means that everyone who assists money launderers is committing the crime of money laundering; this broadened definition now covers anyone caught encouraging money laundering or attempting to launder money.

Clarification of Money Laundering Penalties

The 6AMLD clarified the penalties for money laundering in the EU, to establish a more transparent and consistent approach to financial crime prevention. Under 6AMLD, penalties are clearly defined for both people and corporations engaging in money laundering activities.

Previously, only individuals could be prosecuted for money laundering; however, 6AMLD broadens criminal culpability to include legal entities like corporations or partnerships. The new laws provide that a legal person can be held liable for the crime of money laundering if it is proven that they failed to prevent a “directing mind” from within the corporation from carrying out the illicit conduct. Practically, the new laws impose AML/CFT duty on management staff as well as employees operating independently.

Enhanced Collaboration Among EU Members

6AMLD’s emphasis on greater cooperation aims to develop a more cohesive and interconnected strategy to addressing money laundering concerns across the European Union (EU). The regulation aims to promote seamless coordination among EU member states by adopting uniform provisions for investigative instruments and jurisdictional rules.

One important issue addressed by 6AMLD is the idea of dual criminality, which refers to crimes committed in one jurisdiction and the subsequent laundering of proceeds in another. To address this issue, the directive establishes precise information-sharing standards between jurisdictions, allowing criminal prosecution of related offences in various EU member states.

This means criminalising specific predicate offences such as terrorism, drug trafficking, human trafficking, and corruption, regardless of their legality in individual states. Furthermore, 6AMLD establishes criteria for authorities to consider when determining how and where prosecutions should be conducted, such as the victims’ country of origin, the offender’s nationality or residence, and the jurisdiction where the offence occurred, ensuring a comprehensive and coordinated approach to combating money laundering in the EU.

How to Implement 6AMLD?

Regulated entities must understand the increased regulatory scope and risk environment imposed by 6AMLD. This includes monitoring new predicate crimes. In addition to managing AML resources and educating compliance employees, organisations must assess their technology deployment to ensure that it meets current transaction monitoring and screening criteria.

Organisations should strengthen their customer due diligence (CDD) practices, monitor transactions for suspicious behaviour, and ensure compliance with the directive’s obligations. Leveraging AI, ML, and transaction monitoring technologies enables organisations to effectively identify and flag suspicious activity, which aligns with with 6AMLD’s demand for increased scrutiny.

Summary

The 6th Anti-Money Laundering Directive (6AMLD) is a significant step forward in the EU’s efforts to combat financial crime, adopting comprehensive requirements to improve the integrity of financial institutions worldwide. 6AMLD, enacted in December 2020, broadens the definition of money laundering offences to include helping, abetting, instigating, and attempting such crimes, as well as extending criminal culpability to legal entities. This regulation identifies 22 predicate offences, including cybercrime and environmental crimes, and imposes severe penalties on violators. 6AMLD intends to promote greater collaboration among EU member states and develop clear information-sharing standards in order to combat money laundering and terrorism funding, requiring regulated firms to use sophisticated compliance and monitoring technology.

0 Comments