What is a Beneficial Owner?

Beneficial owner refers to the natural person(s) who ultimately owns or controls an entity and/or the natural person on whose behalf a transaction is being conducted. It also includes those natural persons who exercise ultimate effective control over a legal person or arrangement.

The definition goes on to state that “only a natural person can be an ultimate beneficial owner, and more than one natural person can be the ultimate beneficial owner of a given legal person or arrangement,” emphasising that the ultimate beneficial owner is always a natural person and can be multiple natural persons.

In case the beneficial owner cannot be identified, the senior managing official can be identified and recorded as the beneficial owner of a legal person or an arrangement.

Misusing legal persons, such as shell companies, for money laundering and terrorism financing has been a significant challenge for law enforcement authorities worldwide. As a result, countries have introduced laws to enhance transparency and collect beneficial ownership information.

Since 2003 The Financial Action Task Force (FATF) has strengthened the beneficial ownership transparency standards to respond to the significant misuse of legal persons and arrangements for money laundering, terrorist financing and proliferation of weapons of mass destruction. As a result, in March 2023, FATF issued guidance on Beneficial Ownership of Legal Persons which recognises the importance of the following:

- Countries to use a multi-pronged approach to collect and provide accurate beneficial ownership information for competent authorities and financial institutions to implement customer due diligence and anti-money laundering measures.

- Countries to assess risks of legal persons within their borders, obtain timely and accurate information on beneficial ownership, and strengthen controls on bearer shares and nominee arrangements.

- FATF standards on transparency and beneficial ownership can help countries to prevent the misuse of corporate vehicles for financial crimes but can also help address corruption and tax crimes.

Conducting Risk Assessment

Another important element to prevent the misuse of corporate vehicles for illegal purposes is the requirement of a risk assessment for every country, which need to take into consideration all types of legal persons that can be created under their national laws. Steps that countries can consider during their risk assessment include:

- Collecting and analysing registration statistics, such as incorporation volumes and trends, on all types of legal persons.

- Reviewing and analysing suspicious transaction reports and national law enforcement and prosecutorial cases.

- Identifying the most common typologies of abuse of legal structures with a nexus to their jurisdictions.

- Investigating advertising practices by Trust and Company Service Providers (TCSPs) promoting the jurisdiction as an international centre for incorporation/entity formation.

- Conducting expert consultations with external experts from the private sector, civil society, and academia.

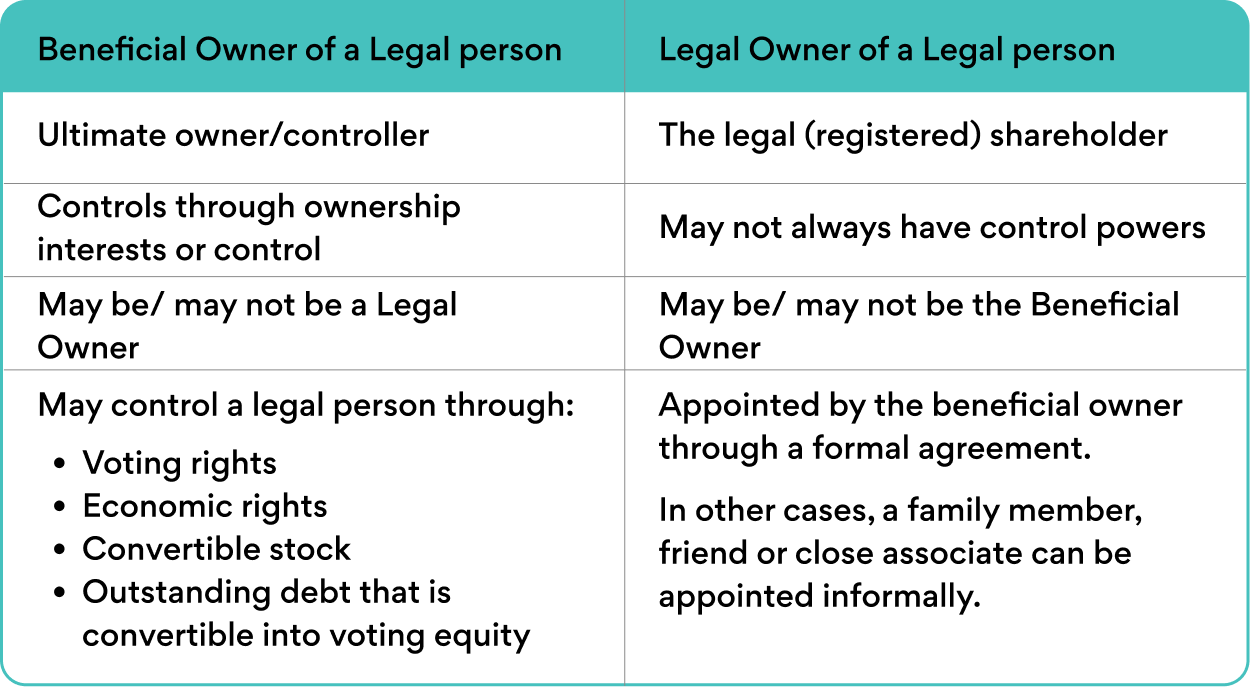

Differentiation between Legal vs Beneficial Ownership

The new guidance explains that legal and beneficial ownership are separate concepts. While the legal owner and beneficial owner may often be the same person, in some instances, the beneficial owners of a company may not be the legal (or registered) owners. In such cases, individuals who exercise ultimate control over a legal entity should be identified as beneficial owners, regardless of whether they hold shares above any specified minimum ownership threshold.

Individuals who exercise ultimate control over a legal person must be identified as the beneficial owners, regardless of whether they own shares above any specified threshold.

Verification Mechanisms as part of the Multi-Pronged Approach

The beneficial ownership information must be held in a beneficial ownership registry or an alternative mechanism that allows law enforcement and competent authorities to obtain timely and accurate information.

The information included in the beneficial ownership register must be verified by the responsible authority to ensure accuracy through a combination of checks or other processes.

The process of verifying the beneficial owners can happen in different ways depending on how countries collect and store the ownership information. However, the multi-pronged approach can be applied by obtaining information from:

- The companies themselves (in the case of the “companies’ approach”)

- The authority or body responsible for maintaining the register of beneficial owners or alternative mechanism (in the case of the “registry” approach or the “alternative mechanism” approach)

- Other entities that may have supplementary information that can help determine the beneficial ownership of a company, such as regulators or stock exchanges.

For example, verification can be done through a review of documents submitted, such as share certificates, shareholder registers, board meeting resolutions, and power of attorney documents. This information can be then cross-checked with relevant government and other available databases such as population or national identity registers, taxpayers’ identification register, vehicles, and land registries.

Enhanced verification mechanisms can also be used to detect inaccuracies in reported beneficial ownership information and/or deliberate concealment, such as undisclosed nominee relationships. Law enforcement authorities may conduct such checks of a more investigative nature.

FATF’s report emphasises that a multipronged approach using several sources of information is more effective than using a single approach in preventing the misuse of legal persons for criminal purposes.

Bearer Shares and Bearer Shares Warrants

According to FATF guidance, bearer shares refer to “negotiable instruments that accord ownership in a legal person to the person who possesses the physical bearer share certificate, and any other similar instruments without traceability”.

Bearer share warrants refers to “negotiable instruments that accord entitlement to ownership in a legal person who possesses the physical bearer share warrant certificate, and any other similar warrants or instruments without traceability”.

The above do not refer to dematerialised form of bearer shares or warrants or other instrument that the beneficial owners can be identified.

The key features of bearer shares and bearer share warrants are as follows:

- Physical bearer share certificate or physical bearer share warrant certificate

- Untraceable ownership

Countries should not permit legal persons to issue new bearer shares or bearer share warrants and take measures to prevent the misuse of existing bearer shares and bearer share warrants. Any existing bearer shares or bearer share warrants should be converted into a registered form or immobilized.

Nominees

Nominees can be used as a deliberate device to evade beneficial ownership transparency rules, posing an obstacle to transparency and facilitating the misuse of companies and other corporate vehicles for money laundering and related crimes. The most common types of nominees are nominee directors and nominee shareholders.

The transparency requirement for nominees is:

- Nominee shareholders and directors must disclose that they are acting as a nominee and the identity of the nominator upon whose instructions they are acting to the company.

- The company must keep a record of the identity of the nominator.

What is Next?

Enhancing the transparency of legal persons through the collection of beneficial ownership information is a critical step in preventing the misuse of corporate vehicles for money laundering or terrorism financing.

Following FATF’s Beneficial Ownership Guidance, we anticipate that nations will use a multi-pronged strategy when implementing new legislation or enhancing current ones. The ultimate purpose is to ensure that companies and other entities are collecting and verifying beneficial ownership information effectively. This may require collaboration between different entities, such as companies, authorities, and regulators, to ensure that the ownership information is accurate and up to date.

On the other hand, we expect to see new measures for shell companies, bearer shares and nominee shareholders. All these measures have one ultimate purpose: To prevent the misuse of legal persons and arrangements for illegal purposes!

0 Comments